Coming Soon

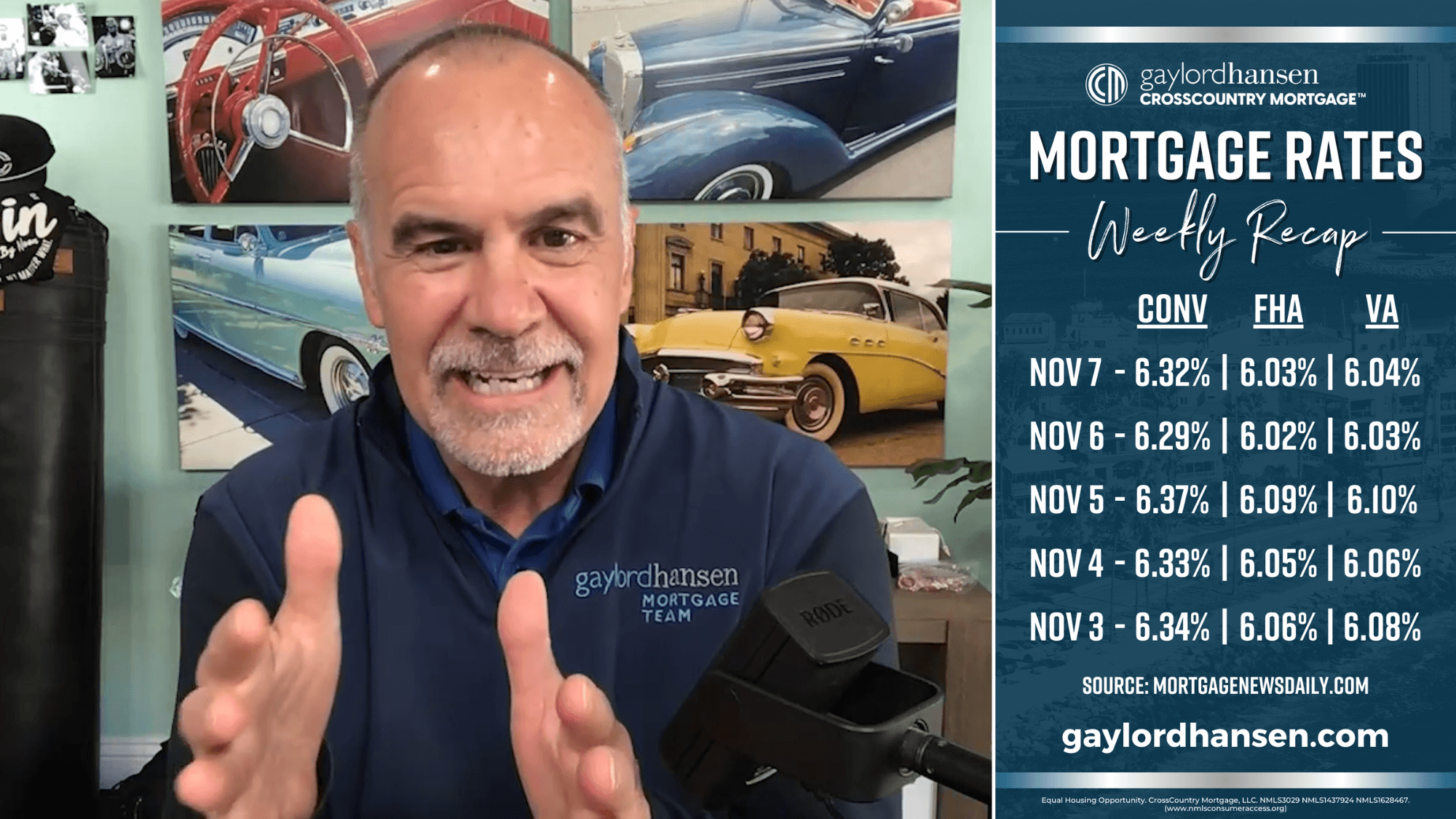

The markets are flying blind right now. With key economic data delayed, no one has a clear read on what’s happening with jobs, inflation, or the next Fed move. That uncertainty has kept mortgage rates hovering near 6.32% for prime borrowers, steady but unpredictable.

Every small report is moving the market. The ADP jobs data looked strong, yet the Challenger report showed more than 150,000 job cuts in October and fewer companies hiring for the holidays. It’s a confusing picture, and everyone — from the Fed to Wall Street to homebuyers — is waiting for clarity.

For buyers, this moment offers opportunity. Sellers are still offering concessions, inventory is improving, and competition remains lower than usual. Once confidence returns and data starts flowing again, demand will rise quickly, especially heading into spring.

If you’ve been waiting for the right time to move, use this period to get prepared. Review your financing, get pre-approved, and understand your numbers so you can act fast when the market shifts. The markets may be flying blind, but informed buyers can still move with confidence.

The information contained is the viewpoint of the presenter(s). Individuals should consult their own financial representative.

Estimated Mortgage Payment is for exemplary purposes only. Contact a licensed loan officer for exact numbers and APR. Additional rates and terms may apply and are subject to change without notice. Loan scenario assumes a purchase price of Zillow's list price and a 10% down payment. Points and fees not included. Property tax, homeowners insurance, mortgage insurance, and HOA fees are approximate and may vary. Other fees may apply. Product displayed is a conventional 30-year fixed rate mortgage using the current average rate as shown on Mortgage News Daily (mortgagenewsdaily.com).

Estimated Qualifying Income assumes a homebuyer has a FICO score above 740, no other credit debt, and a debt-to-income (DTI) ratio of 43%.

For exact numbers and APR or to run a loan scenario based on your own credit and income, contact our office at (858) 259-8700.

Rate Source: Mortgage News Daily. Rates displayed are approximate, subject to change, and do not necessarily reflect rates available to you. MND’s methods involve an objective component based on lenders' raw prices as well as a subjective impression from their network of originators. For more information about how these rates are calculated, visit www.mortgagenewsdaily.com/mortgage-rates/about.

Mortgage News Daily (MND) is a trademark of Brown House Media, Inc. Zillow is a trademark of Zillow, Inc. CrossCountry Mortgage has not been authorized, sponsored, or otherwise approved by Brown House Media, Inc. or Zillow, Inc.

Equal Housing Opportunity. All loans subject to underwriting approval. Certain restrictions apply. Call (858) 259-8700 for details. All borrowers must meet minimum credit score, loan-to-value, debt-to-income, and other requirements to qualify for any mortgage program. CrossCountry Mortgage, LLC is an FHA Approved Lending Institution and is not acting on behalf of or at the direction of HUD/FHA or the federal government. CrossCountry Mortgage, LLC is not affiliated with or acting on behalf of or at the direction of the Veteran Affairs Office or any government agency. Certificate of Eligibility required for VA loans. By refinancing, the existing loan total finance charges may be higher over the life of the loan.