Video

A Quiet Shift Toward Lower Rates

Market Update

Coming Soon

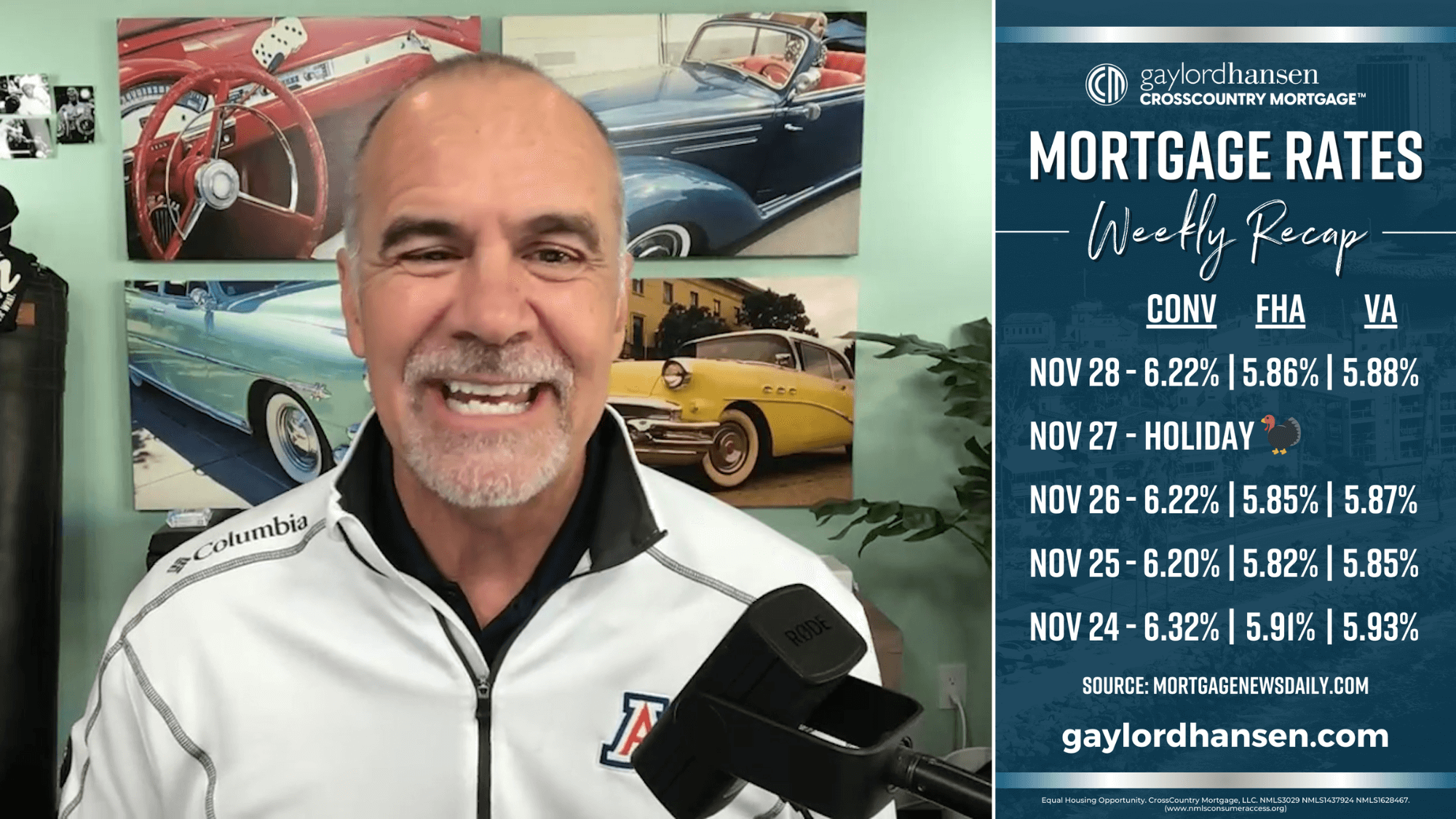

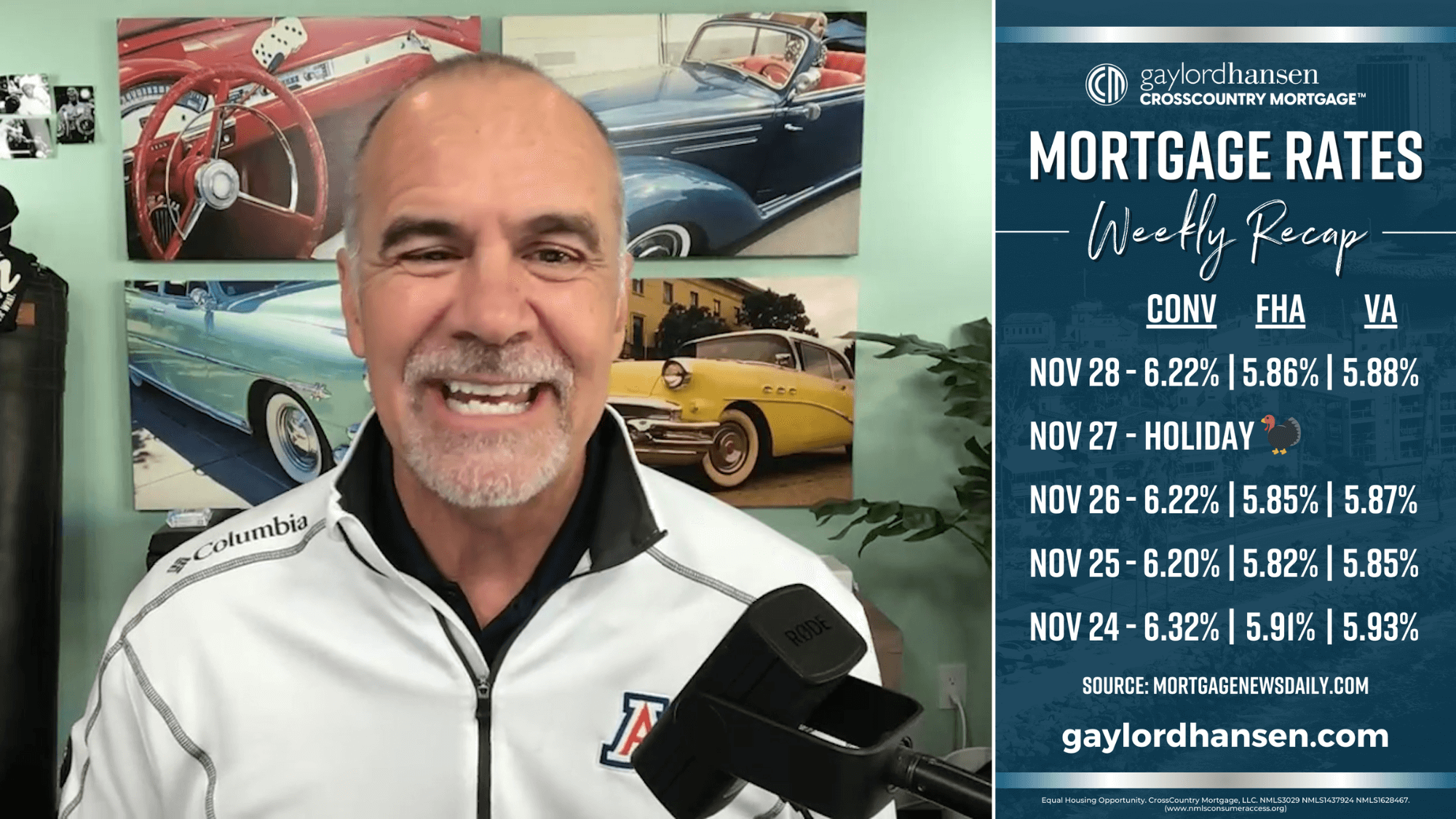

Mortgage rates dipped again this week, and the shift is starting to bring some real encouragement for homebuyers. The 30 year conventional rate is near 6.22% and drifting back toward the lows we saw earlier in the fall. With new economic data coming back after the shutdown, early signs show a softer job market and inflation that is finally holding steady. This combination has brought the possibility of a December rate cut back into focus, and that can change the entire feel of the market.

Lower rates can open doors that felt closed. Even a small drop can give you a lower payment, help you qualify more easily and create a sense of momentum that many buyers have been waiting for. Better affordability brings more confidence, and that confidence can make the dream of buying a home feel possible again.

You also have an advantage right now that will not last forever. Sellers are still offering concessions and rate buy downs, which can save you real money and ease the upfront cost of buying. Once demand picks up, those opportunities fade quickly. This moment gives you a rare chance to combine lower rates with stronger incentives, and that can make your path to homeownership smoother than it has been in a long time.

If you have been feeling stuck or unsure about timing, this shift is worth paying attention to. A small change in rates can create a big change in what you can afford, and it may be the opening you need to move forward with confidence.

The information contained is the viewpoint of the presenter(s). Individuals should consult their own financial representative.

Estimated Mortgage Payment is for exemplary purposes only. Contact a licensed loan officer for exact numbers and APR. Additional rates and terms may apply and are subject to change without notice. Loan scenario assumes a purchase price of Zillow's list price and a 10% down payment. Points and fees not included. Property tax, homeowners insurance, mortgage insurance, and HOA fees are approximate and may vary. Other fees may apply. Product displayed is a conventional 30-year fixed rate mortgage using the current average rate as shown on Mortgage News Daily (mortgagenewsdaily.com).

Estimated Qualifying Income assumes a homebuyer has a FICO score above 740, no other credit debt, and a debt-to-income (DTI) ratio of 43%.

For exact numbers and APR or to run a loan scenario based on your own credit and income, contact our office at (858) 259-8700.

Rate Source: Mortgage News Daily. Rates displayed are approximate, subject to change, and do not necessarily reflect rates available to you. MND’s methods involve an objective component based on lenders' raw prices as well as a subjective impression from their network of originators. For more information about how these rates are calculated, visit www.mortgagenewsdaily.com/mortgage-rates/about.

Mortgage News Daily (MND) is a trademark of Brown House Media, Inc. Zillow is a trademark of Zillow, Inc. CrossCountry Mortgage has not been authorized, sponsored, or otherwise approved by Brown House Media, Inc. or Zillow, Inc.

Equal Housing Opportunity. All loans subject to underwriting approval. Certain restrictions apply. Call (858) 259-8700 for details. All borrowers must meet minimum credit score, loan-to-value, debt-to-income, and other requirements to qualify for any mortgage program. CrossCountry Mortgage, LLC is an FHA Approved Lending Institution and is not acting on behalf of or at the direction of HUD/FHA or the federal government. CrossCountry Mortgage, LLC is not affiliated with or acting on behalf of or at the direction of the Veteran Affairs Office or any government agency. Certificate of Eligibility required for VA loans. By refinancing, the existing loan total finance charges may be higher over the life of the loan.