Video

The Game Is Officially on for Homebuyers in 2026

Market Update

Coming Soon

The new year is here, and the housing market is waking up.

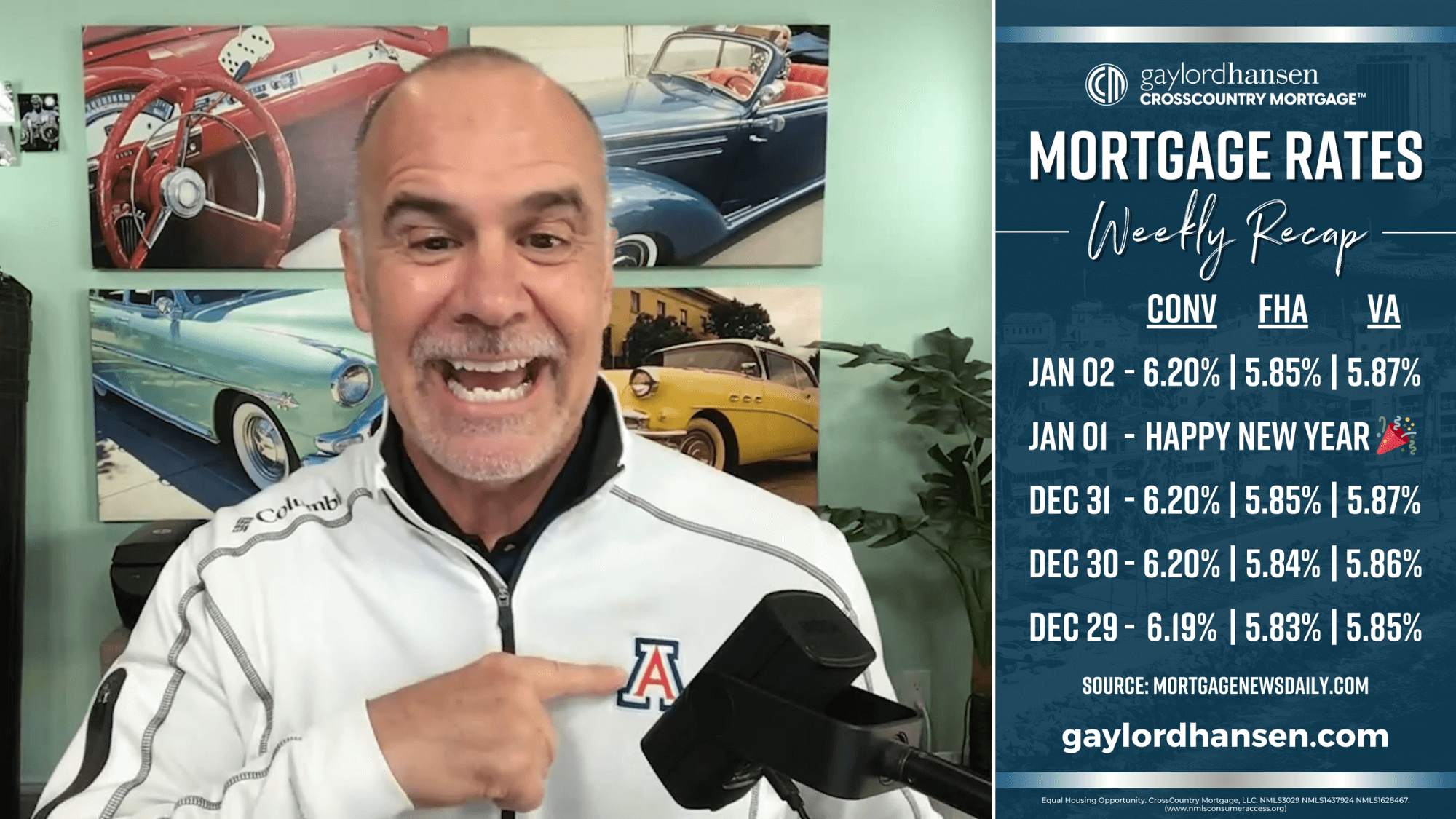

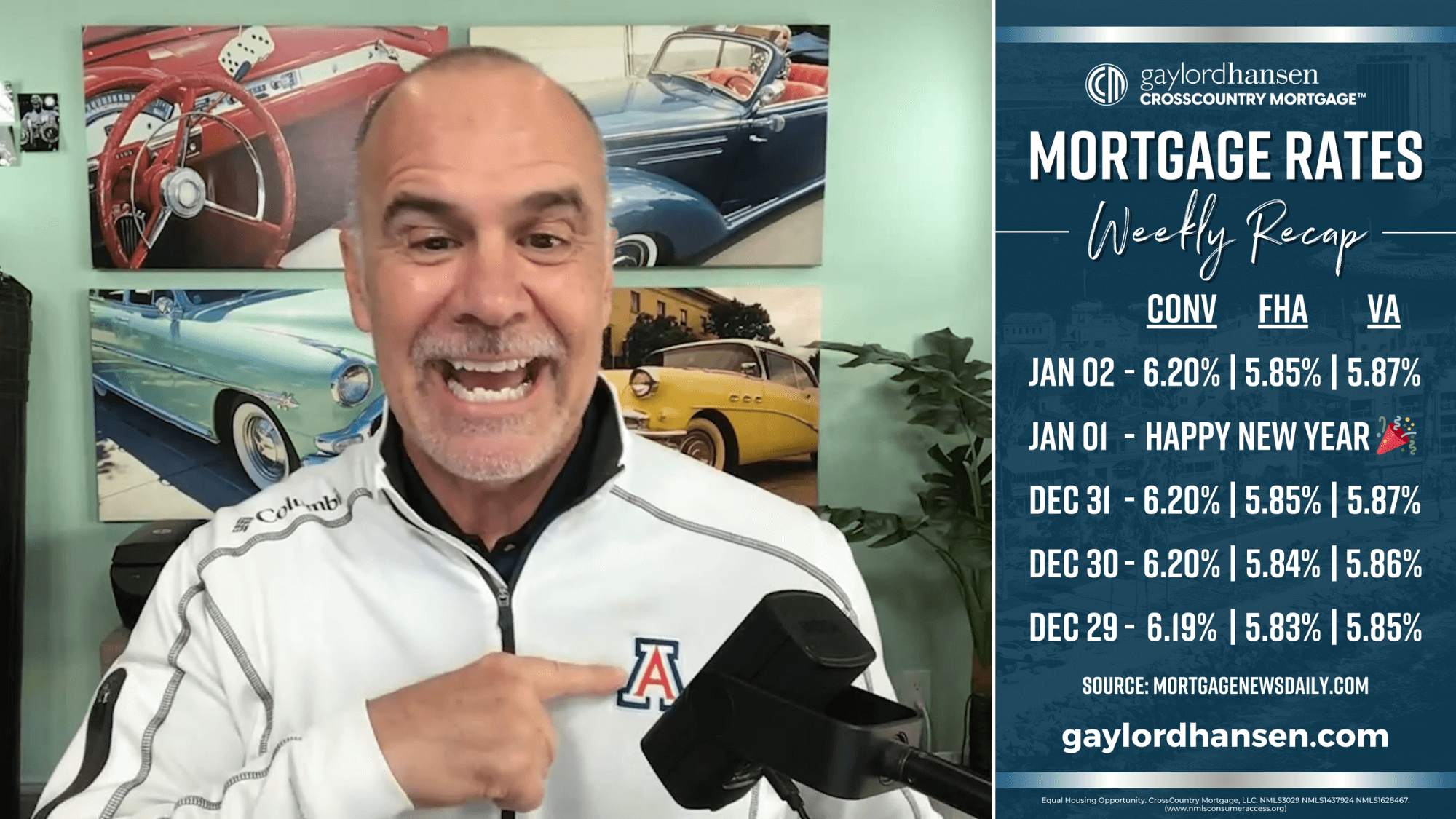

Mortgage rates stayed steady through the holidays, landing around 6.2% for a conventional 30 year fixed loan. After years of ups and downs, stability like this matters more than many buyers realize.

There are also financing options available today that often go unnoticed. FHA and VA loan programs remain below 6%, which can significantly improve affordability for first-time buyers and veterans.

As financial markets return to full activity on Monday, fresh economic data brings more clarity and helps buyers plan with greater confidence.

Inflation continues to cool, even though prices remain elevated. That is why things still feel expensive, but the pace of increases has slowed, which supports longer-term decision-making.

Lower gas prices have also helped household budgets, easing some of the pressure many families have felt.

Most reputable forecasts suggest mortgage rates will remain in the low 6% range throughout 2026. While the market looks different than it once did, opportunity still exists for buyers who understand today’s conditions and prepare accordingly.

The market is waking up, options exist, and informed buyers are better positioned to move forward with confidence.

The new year is here, and the housing market is waking up.

Mortgage rates stayed steady through the holidays, landing around 6.2% for a conventional 30 year fixed loan. After years of ups and downs, stability like this matters more than many buyers realize.

There are also financing options available today that often go unnoticed. FHA and VA loan programs remain below 6%, which can significantly improve affordability for first-time buyers and veterans.

As financial markets return to full activity on Monday, fresh economic data brings more clarity and helps buyers plan with greater confidence.

Inflation continues to cool, even though prices remain elevated. That is why things still feel expensive, but the pace of increases has slowed, which supports longer-term decision-making.

Lower gas prices have also helped household budgets, easing some of the pressure many families have felt.

Most reputable forecasts suggest mortgage rates will remain in the low 6% range throughout 2026. While the market looks different than it once did, opportunity still exists for buyers who understand today’s conditions and prepare accordingly.

The market is waking up, options exist, and informed buyers are better positioned to move forward with confidence.